- CUSTOM

- AFFORDABLE

- INSTANT

- SEAMLESS

- SECURE

- SPEEDY

- GENDER NEUTRAL

- EASY

- CUSTOM

- AFFORDABLE

- INSTANT

- SEAMLESS

- SECURE

- SPEEDY

- GENDER NEUTRAL

- EASY

- CUSTOM

- AFFORDABLE

- INSTANT

- SEAMLESS

- SECURE

- SPEEDY

- GENDER NEUTRAL

- EASY

- CUSTOM

- AFFORDABLE

- INSTANT

- SEAMLESS

- SECURE

- SPEEDY

- GENDER NEUTRAL

- EASY

WHY ASTEYA'S BETTER

Protection for your paycheck. Simplified.

We've developed a first of its kind online platform that provides you with the fastest and easiest experience possible.

How it works:

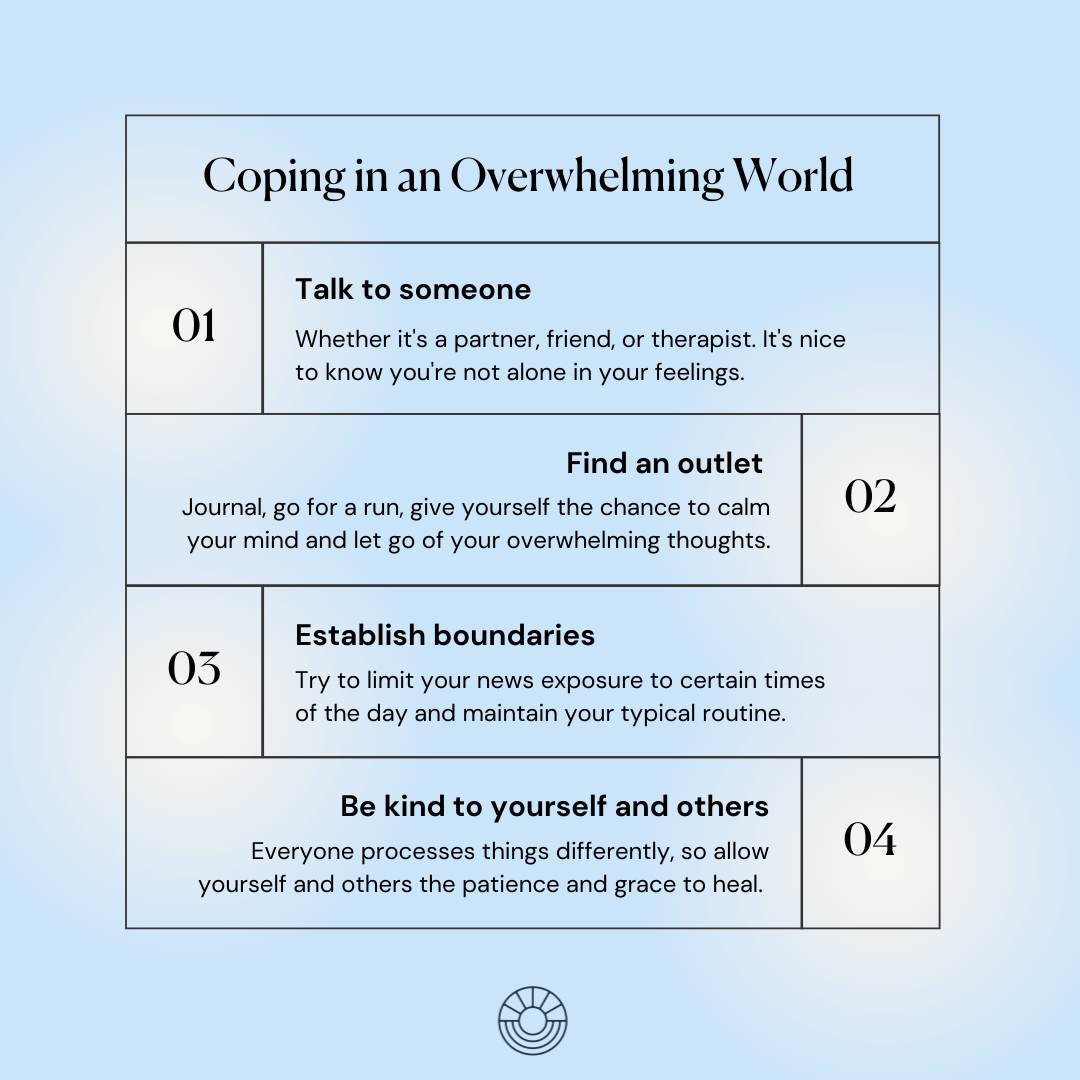

1. Easy application

Fill out your application from anywhere, at any time, with no wait.

2. Instant policy

A seamless process that delivers your policy directly to your inbox, so you'll never lose it.

3. Real assurance

Rest easy knowing you're covered.

4. Get paid

Be paid out directly on an approved claim, and spend without restrictions once it's in your bank account.

Built for Everyone.

Everyone deserves the opportunity to protect their quality of life and their future, which is why we've made our Income Insurance as inclusive and accessible as possible.

From corner store employee to corner office executive, our products were created to fit every budget and lifestyle.

Follow us on Instagram!

Show us how you #FocusOnLiving @asteya.world

Popular Questions

-

They're the same, but we like to highlight what it’s intended to protect… your income!

While we can’t prevent you from becoming injured or disabled, our insurance policies are there to protect the income you receive via your earned wages in situations where you’re not able to earn a living due to a disability. That’s why we like to think of it as income insurance instead. -

From as little as $6 per month, you can take out either:

- A permanent disability income insurance policy: You’ll receive up to a $500,000 one-time benefit should you become permanently and totally disabled and are not expected to return to work in your lifetime.

- A monthly disability income insurance policy: You’ll get benefits up to $20,000 per month until you’re able to return to your regular occupation.

-

Here’s the short answer: anyone who earns money through work. It’s really that simple. Income insurance is a partial income replacement benefit that helps you pay for everyday expenses without blowing through savings when you’re not able to work due to illness or injury. Did you know that 1 year of disability can wipe out 10 years of savings?

If you have a work-sponsored policy, and you leave the company, your policy isn’t portable, meaning you can’t take it with you. With private income insurance, you’re the one in control.

-

You’ll always need to read the fine print to fully understand what’s covered. To make a claim against your policy, you’ll be required to submit some paperwork. This includes a written benefit’s claim, an Attending Physician’s Statement signed by your doctor that outlines your medical condition(s), and an Authorization to Obtain Information so that we can access any additional medical records that relate to your claim. These requirements vary by insurance company, so make sure to contact your insurance provider for more information.

-

Income insurance policy costs vary based on many factors like (but not limited to) health risk, age, benefit amount, waiting period, benefit period, or policy term. At Asteya, we have a variety of options to fit your budget.

-

Income insurance pays a benefit that replaces a portion of your income or provides you with a lump sum payment if you become too sick or injured to work. For disability coverage, and after the onset of a disability, you’ll need to complete a "waiting period" or "elimination period" (as the insurance world likes to call it), where you were unable to work, and your disability was continuous through the "waiting period" or "elimination period" and you were under the care of a doctor of an appropriate type for your injury or sickness. Once your benefits begin, they'll continue until the disability ends and you can return to work or until the benefit period and/or lump-sum provided by the policy ends.

-

Income insurance is for anyone who wants a safety net of financial security. However, certain factors can increase your need for income insurance and may be necessary if you:

- Do not have sick or annual leave because you are self-employed or a small business owner.

- Have family members or dependents who rely on your income.

- Have debt that requires weekly, monthly, or annual payments even if you can't work.

The earlier you jump on the income insurance train, the faster you are on track to financial security! If you are young and healthy now, then qualifying for a policy is easier and the premiums are much lower -- no reason to wait!

-

With income insurance, cheap is chic as long as quality and care are included too! Whether you're wanting to safeguard your assets or maximize income security, our policies are designed to fit your specific needs.

Our focus is on protecting your income and providing a way for you to feel secure without breaking your budget. In fact, income insurance is one of the least expensive insurance coverages.

NEED GUIDANCE?

Asteya's customer experience team is here for you.

Speak to one of our team members at support@asteya.world